Source Proprietary Deals Through Your Network

Verata combines relationship intelligence with private company data to help PE firms find targets, identify warm paths, and get to companies before they hit the market.

Trusted by deal teams at leading PE firms including 3 of the top 10

Your Network is Your Edge. But You Can't See It.

You've spent decades building relationships. So has your team. Partners, Principals, alumni, advisors—thousands of connections across the PE ecosystem.

But when you're trying to reach a specific CEO or find companies that match your thesis, all that relationship capital is locked in people's heads and LinkedIn profiles. No one has a complete picture.

“Do we know anyone at this company?”

Asked dozens of times a week, answered by guessing

“Who's the best path to this founder?”

Hours of LinkedIn searching for each target

“What's this company's revenue?”

Private company data scattered across sources

“Who else fits our thesis?”

Market mapping takes days of manual work

The Complete Sourcing Platform

Everything your deal team needs to source systematically—relationship intelligence and private company data in one place.

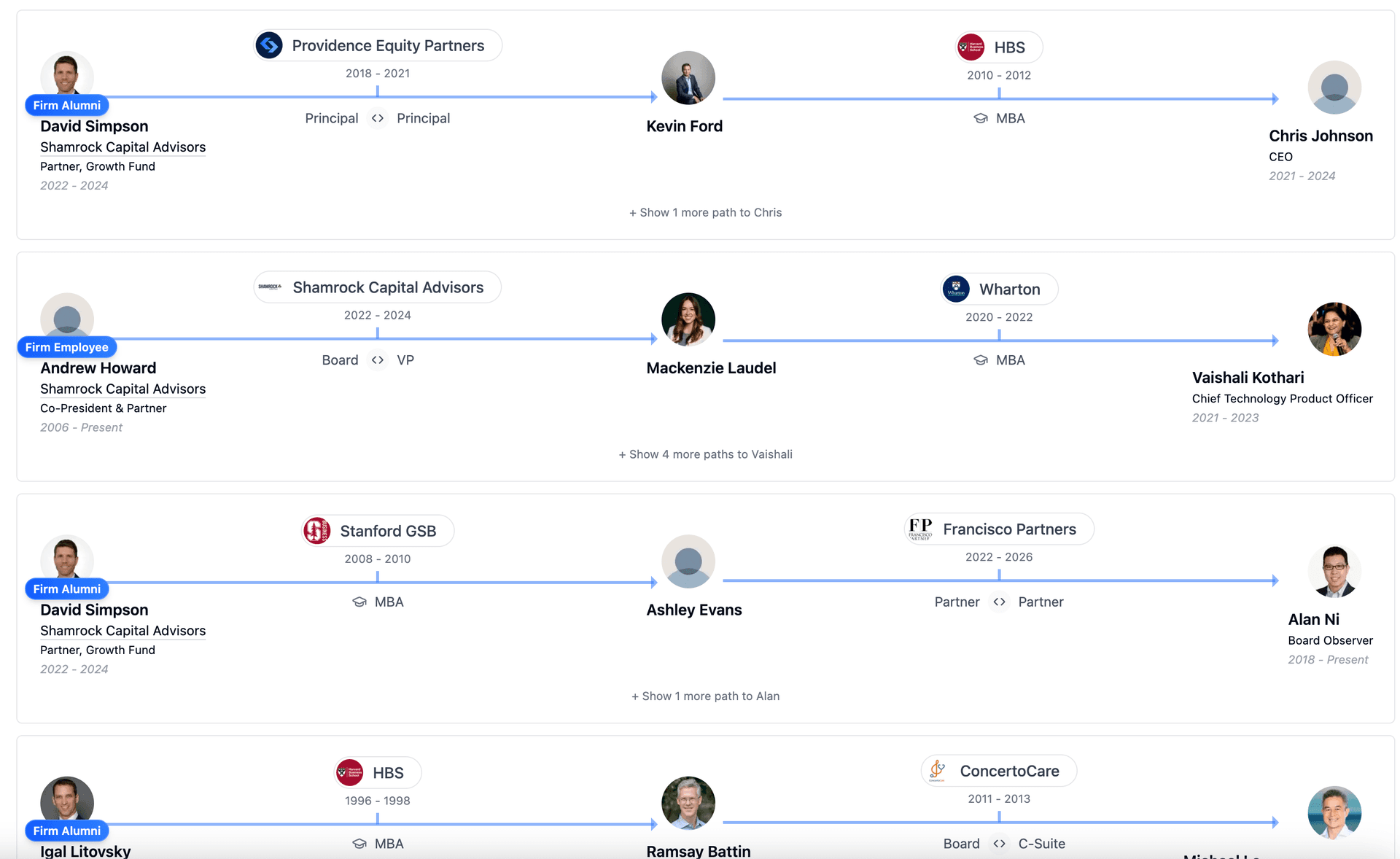

Relationship Path Mapping

See how your firm connects to any target company or executive. Visualize the warm paths that turn cold outreach into warm introductions.

- Identify high-quality, verified professional relationships across your network

- Visualize paths to any target through verified professional connections

- See shared context that makes introductions warm—not LinkedIn's low-quality connections

- Track which relationships are being actively cultivated

“We found a path to a founder through an operating partner we'd never have thought to ask. One warm introduction and we had a meeting. That's proprietary sourcing.”

Principal

Mid-Market PE Firm

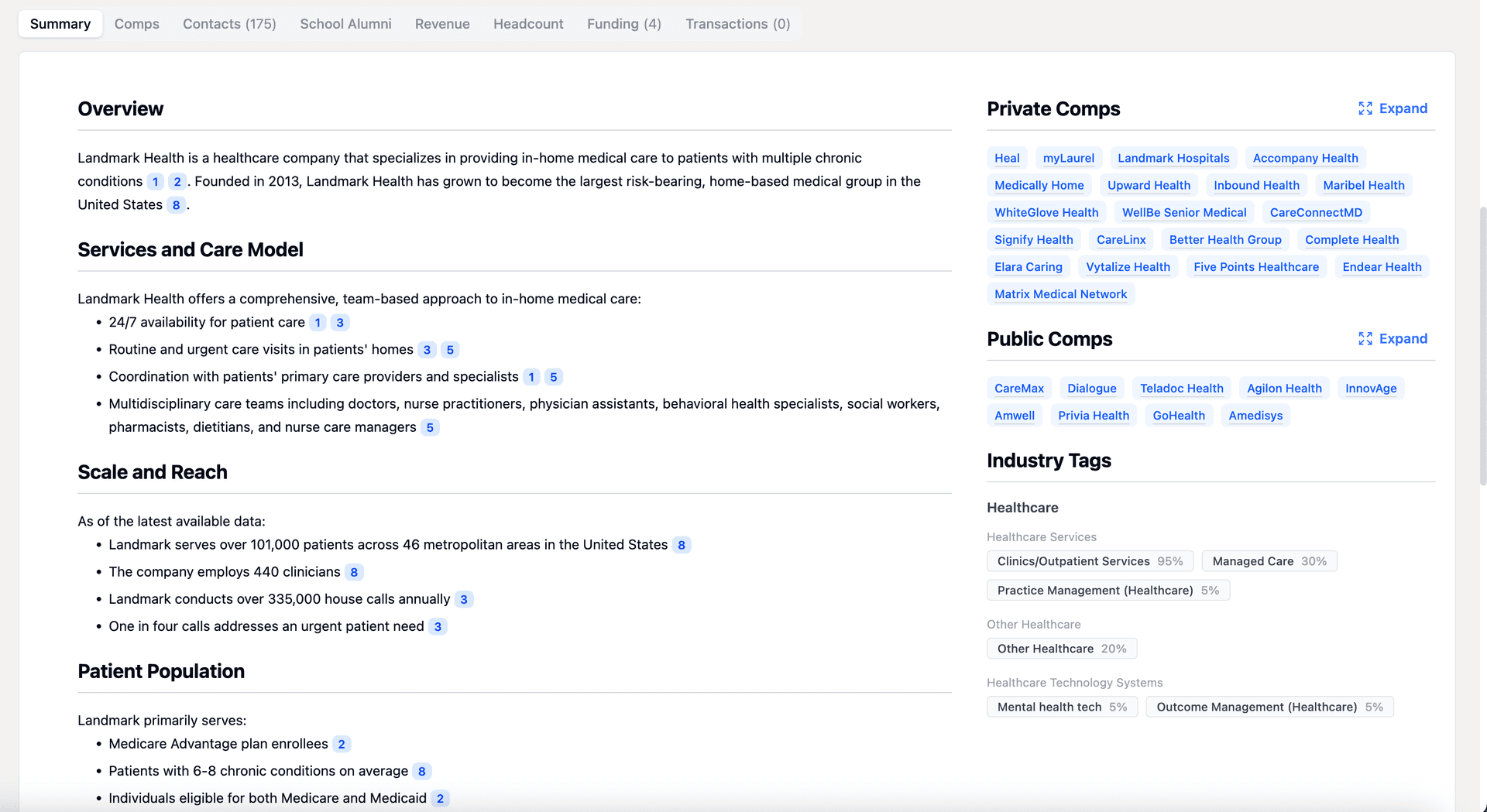

Private Company Intelligence

Research any target company in seconds with comprehensive profiles that go beyond what's publicly available.

- Revenue estimates with transparent methodology

- Headcount trends and growth trajectory

- Funding history with investor details

- Leadership profiles with career histories

- Comparable company analysis

“I walked into a meeting knowing their revenue estimate, their headcount trajectory, and that their CFO used to work with our Operating Partner. The CEO asked how I knew so much.”

Director

Healthcare PE Firm

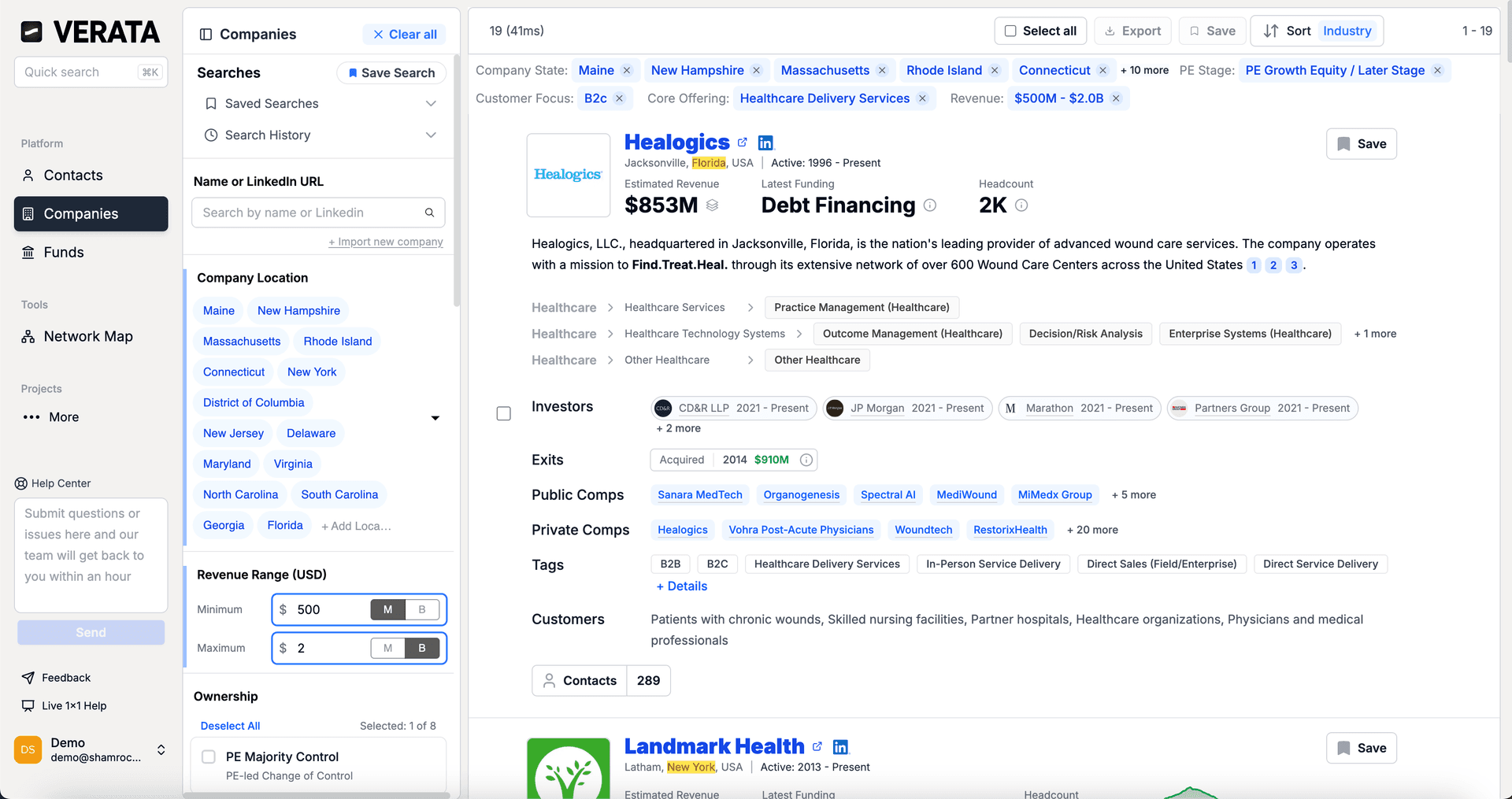

Targeted Search & Alerts

Find every company that matches your thesis criteria, then stay updated as the market evolves.

- Filter by geography, revenue range, sector, ownership type

- See results with key metrics inline

- Save searches and get alerts when new companies match

- Export to Excel for further analysis

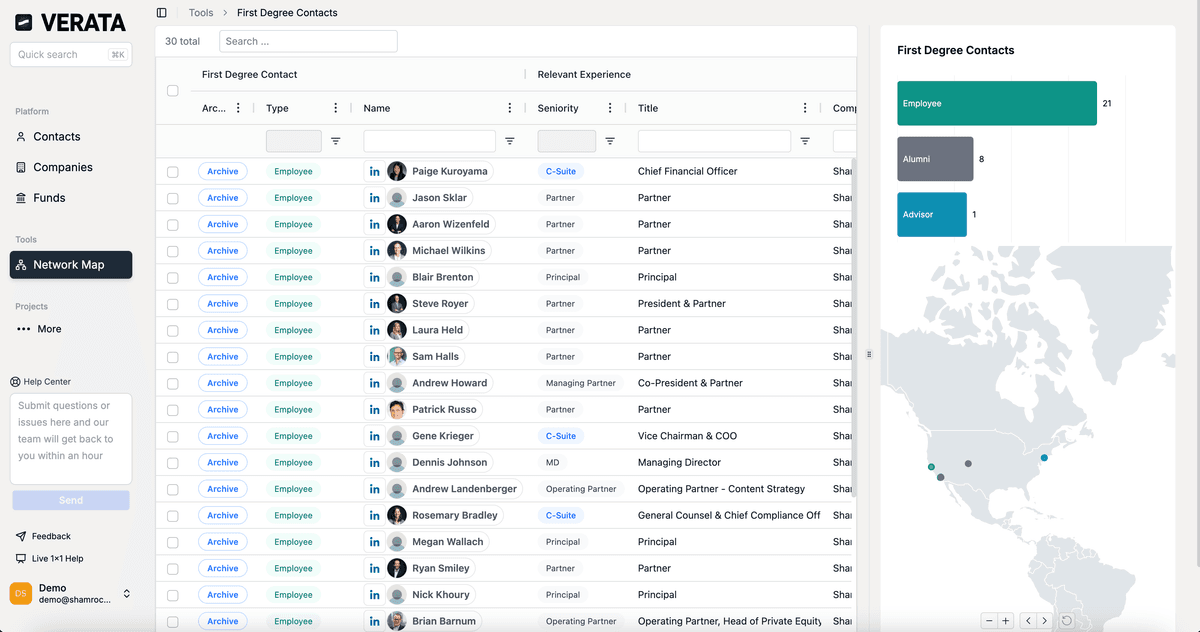

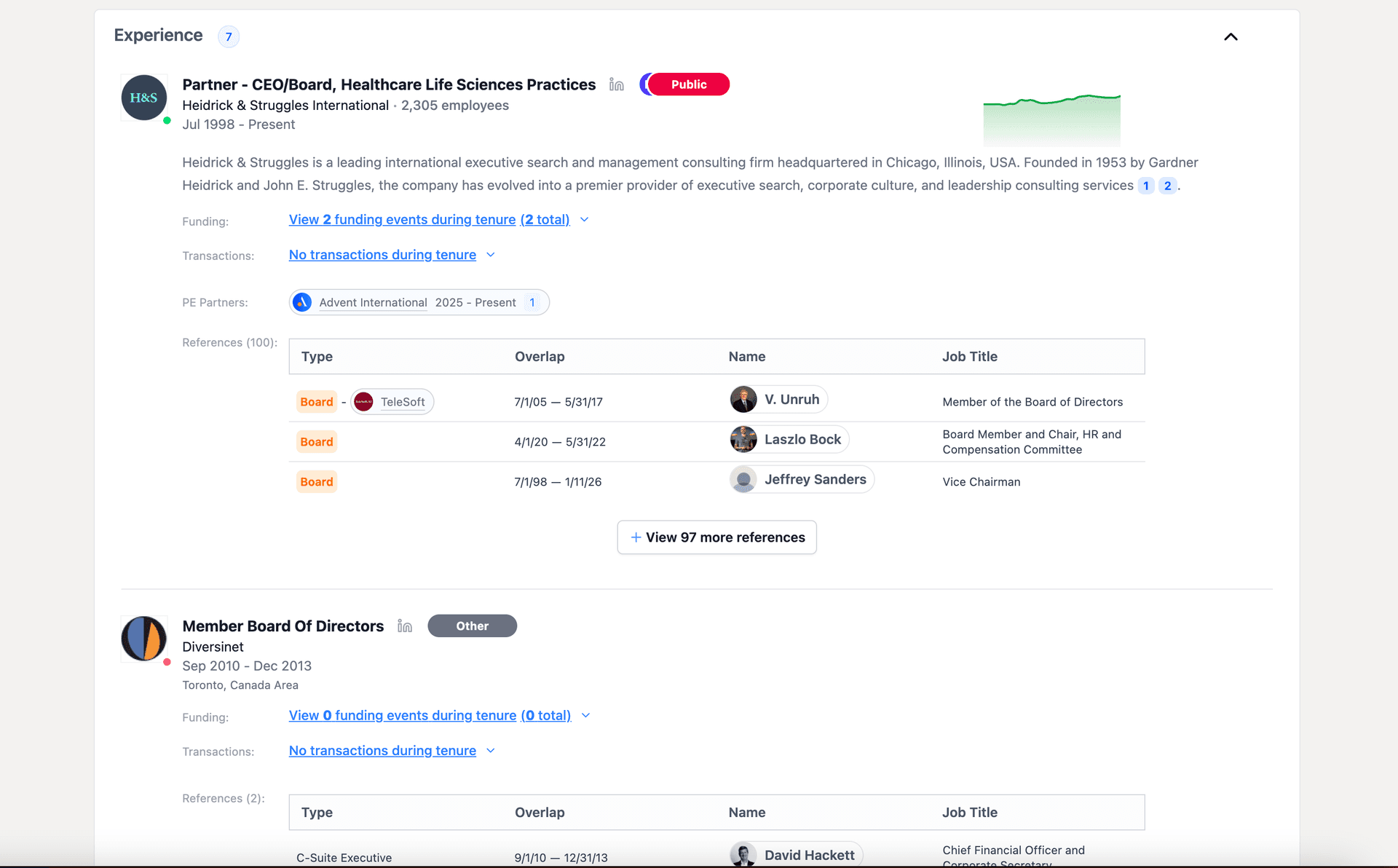

Contact Intelligence

Find the right people to reach and understand their background before you connect.

- Full work history with dates and titles

- Board seats and advisory roles

- Transactions during their tenure

- References from overlapping colleagues

The ROI of Proprietary Sourcing

One proprietary deal sourced through relationships pays for Verata many times over.

$150M+

Average deal size

15-20%

Proprietary discount

$20M+

Value created

<$100K

Verata annual cost

“We closed a $200M deal that started with a Verata search. The company wasn't on any banker's radar. We found them, had a path through an alumni connection, and got there first. That one deal paid for Verata for decades.”

Principal, Industrials-Focused PE Firm

What Deal Teams Are Saying

“Verata changed how we source. We went from hoping our network would produce deals to systematically activating it. Our proprietary deal flow is up 40%.”

Managing Partner

$2B AUM Firm

“The combination of relationship mapping and private company data is unique. No other tool gives us both in one place, built specifically for PE.”

Principal

Growth Equity Firm

“We closed two proprietary deals in our first year that we can directly trace to Verata. The ROI calculation isn't even close.”

Partner

Mid-Market Buyout

Start Sourcing Through Relationships

Join leading PE firms including 3 of the top 10 using Verata to find proprietary deals through their network.

14-day free trial • No credit card required • See your firm's actual network mapped

Frequently Asked Questions

We identify high-quality professional relationships from verified sources using proprietary methods. Unlike LinkedIn—where people accept requests from anyone—every Verata connection represents a real professional relationship. You won't embarrass yourself asking the wrong person for an introduction.

We estimate revenue using comparable company analysis—the same methodology you'd use in a model. We show you the comps we're using and the methodology so you can assess confidence. For most private companies, it's the best estimate available.

Verata integrates with DealCloud, Salesforce, and Affinity on Professional and Enterprise tiers. Your pipeline stays synced without double entry. Most firms use Verata as the starting point for sourcing research, with deals then tracked in their existing CRM.

Most firms are operational within 1-2 days. We import your team's connections, map your network, and have you seeing relationship paths immediately. No heavy IT project required.